The Dawn of Intellectual Property Financing in Kenya

- Jacquelene Mwangi |

- August 8, 2016 |

- CIPIT Insights

The use of intellectual property as collateral is a phenomenon that has risen to recognition by banks and other lending institutions in developed countries, over the years. This phenomenon, previously unheard of in Kenya, is now set to get off the ground through the Movable Property Security Rights Bill, 2016.

The purpose of the Bill is to provide for the use of movable property as collateral for credit facilities and to establish a collateral registry to facilitate registration of interests in movable property. If passed, Kenyans will be able to use their intellectual property, including copyright, patents, trademarks, certificates for industrial designs, certificates for utility models, and other related rights, to create security rights through which they can acquire credit facilities.

The impact of this Bill with particular reference to intellectual property (IP) financing is three fold. One, it reinforces the State’s Constitutional obligation to support and promote the IP rights of Kenyans; two, it enables further recognition and respect for IP by inventors who may find an incentive to duly register their intellectual property; this respect for IP is also extended to banks and other lending institutions which will then be expected to consider loan applicants who present their IP assets as security.

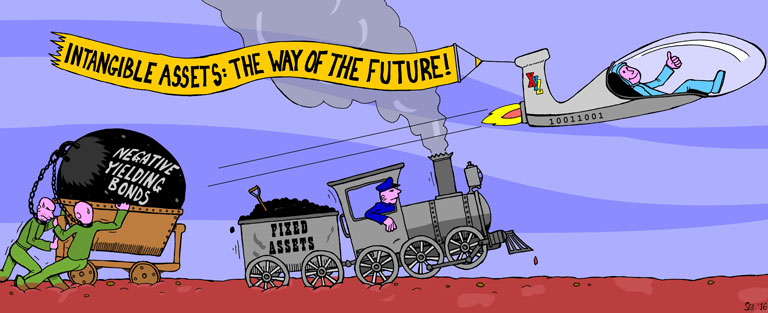

Why should corporate top management and policy makers care about IP assets? Or be interested in the latest trends in financing IP assets? Because they cannot afford to do otherwise. IP rights are not only valuable assets but can also be important sources of financing. The desire to enhance innovation is a very important issue for all nations, and access to financing is critical for start-up companies and innovative SMEs- WIPO Magazine, Sept 2008

The potential of IP financing in Kenya is clearly great for individuals, companies and for the country as it transitions into a knowledge based economy. The efficiency is enhanced through the collateral registry which will be established for purposes of receiving, storing and making accessible to the public, information on registered security rights.

The opportunity is however not presented on a silver platter; a major hurdle likely to influence the uptake of IP financing is IP valuation which would be required in order to give value to a particular IP asset and make a determination as to whether the asset is viable as security. Valuation would provide a guide as to the current market value of the asset, its growth potential, and the future income likely to be generated by the asset. Needless to say, job opportunities will be created as IP transactional and valuation services will be required to enable IP financing.

The need for maintaining and monitoring the IP asset is another challenge likely to influence the uptake of IP financing. This is because, just like any other property, IP has to maintained in order to exploit its full value. This would be important in light of the risk of market fluctuations and obsolescence which faces many technological innovations overtaken by newer technologies. The need for monitoring is heightened due to infringement risks that face the asset. The grantor and the lending institution would thus be interested in monitoring competitors and looking out for infringing activities. There are uncertainties as to which party would bear the burden of IP monitoring and the related impact of IP infringement to the security agreement.

Nevertheless, the dawn of IP financing in Kenya is not to be looked at in the negative. It is a confirmation that intellectual property has established its ground in Kenya and that given time, intellectual property financing will be the new trend in Kenya’s knowledge based economy.

Image Credit: WIPO/S’ebastien Couture

Towards Intellectual Property Securitisation in Kenya: Movable Property Security Rights Act Passed | CIPIT Blog