Application of Bitcoin Technology in Protection of Digital Intellectual Property

- CIPIT |

- March 10, 2015 |

- Bitcoin,

- Blockchain,

- Guest Post,

- Information Technology,

- Intellectual Property

by Wanjiku Karanja

The turn of the 21st century saw the creation and use of digital currencies i.e. internet based mediums of exchange that allow instantaneous transactions and borderless transfer of ownership. These currencies developed during the internet boom of the 1990’s. Examples include: E-gold and Liberty Reserve (both shut down by the US government).

There has, however, been a resurgence in the interest in and creation of digital currencies in the last decade. The most notable of these creations is “Bitcoin”; the most widely used and accepted digital currency.

Bitcoin is touted as the world’s first decentralized currency as it allows transactions to occur directly between parties without the mediation of a financial institution. This feature makes it extremely attractive as it provides a degree of anonymity to the parties. Bitcoin employs cryptography to secure its transactions and control the creation of new units. Its protocol limits the total number of coins that can be created to 21 million units, thus eliminating inflation due to the lack of the erosion of the parties’ purchasing power.

While the true identity of its creator(s) remains unknown, its creation is credited to a Satoshi Nakamoto. It is however speculated that “Nakamoto” may be a pseudonym. The domain bitcoin.org was registered on the 18th of August 2008 at anonymousspeech.com and the first bitcoin transaction took place on the 12th of January 2009 between Nakamoto and Hal Finney; a developer and cryptography activist.

Central to the bitcoin network is a shared public network known as the block chain, where its financial transactions are tracked and recorded. The block chain contains every past bitcoin transaction in chronological order and is maintained by all bitcoin users. These transactions are grouped into “blocks” which are then timestamped and published. Each timestamp is linked to the time-stamp before it thereby forming a chain. Once a block is recorded, it cannot be changed without redoing the work and as blocks are chained after it, it is not possible to change a block without redoing all the following blocks. This creates a public database of all bitcoin transactions.

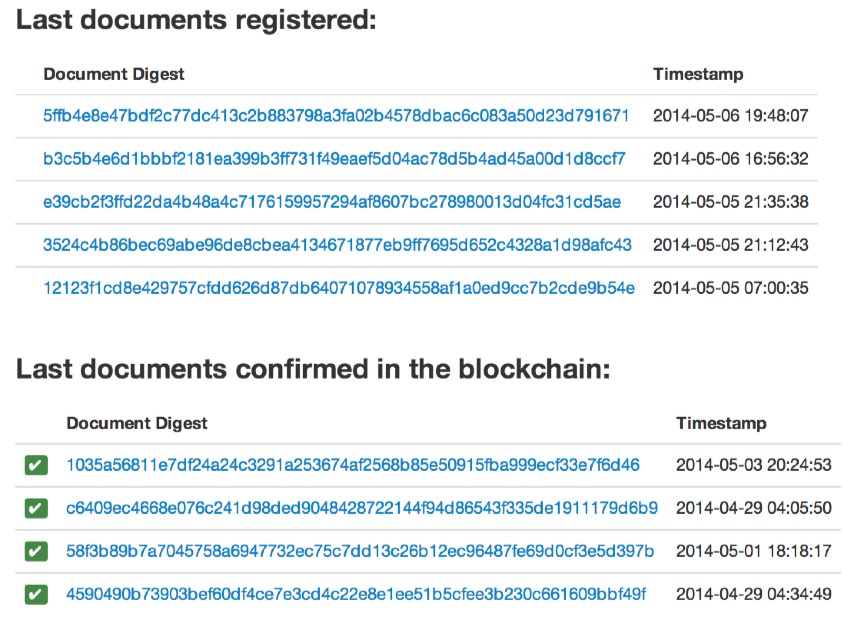

Beyond its use in the bitcoin network, this technology can also be applied in the protection of digital intellectual property due its ability to demonstrate the property’s authenticity, ownership and time of creation, while still preserving the confidentiality of its contents. This would be enabled by the development of commercial services based on it such as the “Proof of Existence” service; a decentralized method of verification built by Manuel Araoz an Argentinian developer, where users pay a fee to upload a document and have its cryptographic proof included in the block chain.

In this respect bitcoin would provide a “means” rather than an “end” in the protection of digital property as it only goes as far as assisting in the enforement of intellectual property rights and would thus require widespread acceptance and enabling legislation to enable the use of its general ledger as a mainstream method of verifying digital property authorship.

A practical avenue for such implementation would be in the maintenance of the Patent Roll. This would help resolve conflicts that often arise during patent registration in cases where it is difficult to establish which party registered a patent for an invention first, as the party with whom the right to the patent lies would be identified from the Patent Roll based on the time of registration.

While bitcoin’s profitability in the financial world cannot be ignored, this blogger notes that its technology’s application in the protection of digital intellectual property may prove to be extremely lucrative due to its capacity to revolutionize the Intellectual Property Management status quo.

John Karanja

Jan